Take Charge of Your Finances

When we invest money, we are primarily concerned about two factors:

What we look for is to maximize returns and minimise Risk. After all, when we invest our money, it makes sense to get the maximum returns from it, but with increasing returns comes the challenge of higher risks. So in this context, what would be a good avenue to invest in- a Fixed Deposit or Mutual Funds. Lets look at them in detail.

Fixed Deposits are the typical and traditional investment choice for most Indian households.FDs offer fixed interest rate to investors for fixed tenures. FD tenures can range from 7 days to 10 years. FD interest rate has seen a steady decline and therefore, there is no protection from inflation, especially when FD interest rates are so low.

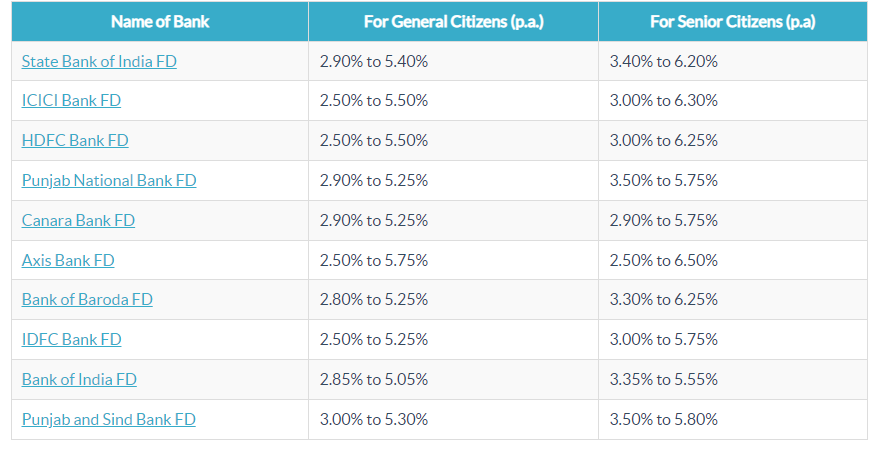

Typical FD rates are as shown below:

One can see that Senior citizens get an additional 0.5%.

FD returns are assured ( you will know upfront the exact returns once you choose the tenure and principal amount). Returns on Investment from Fixed Deposits are taxable, as per income tax slab of investors. So if you are in the higher slabs, be prepared to give up a substantial part of the returns as taxes.

Coming to MUTUAL FUNDS, these are financial instruments managed by Asset Management Companies and formed by pooling money from many investors. Mutual funds are portfolios of stocks or bonds of which unit-holders have ownership. These funds offer a variety of investment options based on investors’ financial needs. Equity mutual funds invest primarily in the stock market whereas debt funds invest in money and bond markets. The primary investment objective of equity funds is capital appreciation and for debt the objective is to generate income.

From a taxation perspective, Mutual funds are one of the most tax efficient investments.

Short term capital gains in equity funds (held for less than 12 months) are taxed at 15% and long term capital gains (held for more than 12 months) of up to Rs 1 lakh are tax exempt and taxed at 10% thereafter.

In debt funds, short term capital gains (held for less than 36 months) are taxed as per the income tax slab of the investor and long term capital gains (held for more than 36 months) are taxed at 20% after allowing indexation benefits. Therefore, in debt fund vs fixed deposit comparison, debt funds scores high.

| Parameters | FD | Mutual Funds |

|---|---|---|

| Safety | Very safe (subject to financial strength of the bank). | Mutual funds are subject to market risks. Different types of schemes have different risk profiles. Invest according to your risk appetite. |

| Liquidity | Medium to Highly liquid. Penalties may apply on premature withdrawals | Open ended funds are highly liquid. Exit load may apply for withdrawals within a certain period from the date of investment |

| Returns | Assured returns | Market linked. Historical returns track record of top performing funds across categories is strong |

| Taxation | As per income tax slab of investors | Long term capital gains tax advantage. If you compare debt fund vs fixed deposit, Indexation benefits in debt funds makes it more tax friendly for investors in higher income tax slabs |

| Investor interest protection | Regulated by RBI | Regulated by SEBI |

You must have heard this quite often: “Mutual funds are subject to market risks”. So there is no assurance of returns unlike FDs. Different mutual funds like equity and debt mutual funds have different risk profiles. Equity as an asset class is much more volatile than debt funds but has the potential of high returns over a long investment horizon compared to debt funds. Equity funds are suitable for long term investment goals while debt funds are suitable for short to medium term goals.

Investors should invest according to their financial goals and risk appetite.

Moderately high to high risk appetite profile investors can invest in equity funds while those who can take only moderate to low risk can invest in debt funds.

Our recommendation – don’t put all your eggs in a single basket. Keep a portion of your money invested in FDs and Debt Funds(more your age, more the percentage of funds in FDs and Debt Funds )- this will be the component of stability, safety and steady returns, and invest the remaining portion in Equity Funds – this will be the high risk, high reward part of the portfolio.

Click here to start investing in Mutual Funds using the Groww App. You will get a singup bonus of Rs. 100 to kickstart your journey.