Take Charge of Your Finances

Would you like to start small and build a steady corpus that will help you achieve your dreams of buying a home or an expensive car? Investing in mutual funds through a Systematic Investment Plan (SIP) is a simple way to achieve your goals.

So, let’s look into what SIP is, how it works, and how they can benefit you.

A Systematic Investment Plan (or SIP) is an investment mode to invest in mutual funds- a systematic method of investing fixed amounts of money periodically. This can be monthly, quarterly or semi-annually etc. When you invest steadily in this manner, it can become easier to meet your financial goals. You can start off your SIP with a sum as little as Rs. 500. It’s about a habit, or a culture of investing regularly.

When you invest in an SIP mode, you invest a fixed sum of money in a given period. Let’s say Rs. 1000 every month on the 20th. This amount lets you purchase a certain number of fund units. If you continue to do this for a long time, you get to invest in the fund during the highs and lows. In other words, you don’t need to time the market to make your investments. Market timing can be a risky proposition as one can invest at the wrong time. SIP investments remove this factor of unpredictability.

Having decided on the investment tenure and frequency, you can choose to automate your investments. Give a standing instruction to your bank to transfer the amount directly from your bank account into the mutual fund SIP of your choice, on a fixed date every month (or quarter) etc..Fintech companies like Groww. have come up with super easy Apps to make SIP creation very easy.

1) Power of compounding

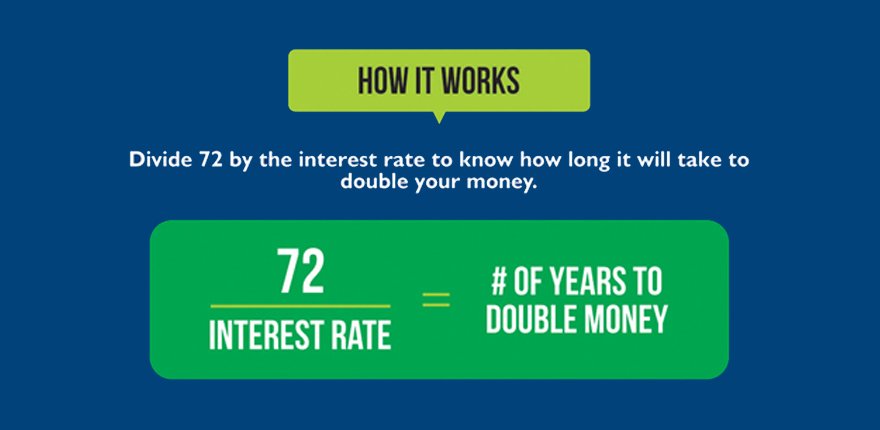

Compounding occurs when the returns you earn on your investments start earning returns. This is a simple concept in theory. But its practical implications are substantial. When you invest regularly through SIPs, your returns get reinvested. Over time, this results in a multiplier-effect, that may increase your potential returns manifold. An ideal way to maximise this gain is to invest for an extended period. This also means you may benefit by investing as early as possible. These are two golden rules for any type of investing and especially for SIPs in Mutual Funds.

Let’s illustrate the kind of corpus an SIP helps generate. Imagine that one starts investing at the age of 20, 30, 40 or 50 and assuming one can invest upto 60 years of age, what would be the returns if one were to invest Rs. 2,000 per month in an equity fund through SIPs.

Assuming an annual return of 12%, here’s how much each one could earn by the time they turn 60:

| Age | Monthly SIP (Rs.) | No. of years | Investment amount (Rs.) | Wealth gain (Rs.) | Final corpus (Rs.) |

| 20 | 2000 | 40 | 9.6 lakh | 2.3 crore | 2.4 crores |

| 30 | 2000 | 30 | 7.2 lakh | 63.4 lakh | 70.6 lakhs |

| 40 | 2000 | 20 | 4.8 lakh | 15.2 lakh | 20 lakhs |

| 50 | 2000 | 10 | 2.4 lakh | 2.2 lakh | 4.6 lakhs |

We can clearly see the exponential nature of SIP returns. We see the golden rule in action – the earlier you start investing, the higher chance that you could grow your final corpus manifold.

2) Low initial investment

You can invest in mutual funds through a SIP with just Rs. 500 per month. This can be an affordable way to invest each month without hurting your spending capacity. You can increase your monthly investment amount with a rise in your income via SIP step-up feature. This can help you reach your investment goals at a faster rate.

3) Rupee cost averaging

Rupee cost averaging is a concept where you purchase more units when the Net Asset Value (NAV) of the fund is low, and lesser units when the NAV is high. Essentially, it averages out your purchasing costs over the tenure of the investment period. You don’t need to worry about how to time the market when you invest through a SIP.

4) Convenience

SIP can be a convenient mode of investing. Like most investors, you may not have the time for extensive market research and analysis to adjust or balance your portfolio. So, once you pick a good fund, you can give standing instructions to the bank and let the SIP take care of your monthly investments.