Take Charge of Your Finances

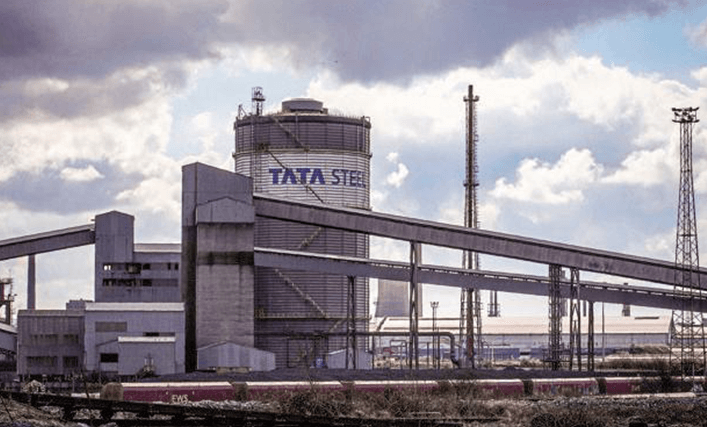

The author of this portal is a fan of Tata stocks – each one of them is a gem with strong fundamentals and is a must-keep in your portfolio. Tata Steel is one such company that will add stability as well as growth to your portfolio, and is a must add to the basket item.

Did you know how Tata Steel manages to be the LOWEST COST PRODUCER OF STEEL IN ASIA?

A brief about the company (sourced from www.tatasteel.com) states this:

Tata Steel possesses and operates captive mines that help them maintain cost- competitiveness and production efficiencies through an uninterrupted supply of raw material. This is how we ensure that we remain the lowest cost producer of steel in Asia.

The Indian product portfolio is divided into four segments

Should I buy TataSteel now?

Due to various factors including Government decisions, the stock has fallen in recent times. This is a good time to buy TataSteel shares. Some quick statistics that will help you decide on buying the stock:

| Current Price | ₹ 885 (Around) |

| 52-Week Low | ₹ 827 |

| 52-week high | ₹ 1534.5 |

| 1-month trading band | ₹ 827 – ₹ 1088.9 |

| Market Capital | ₹ 1,08,268.57 Cr |

| Dividend Yield | 5.76 % |

If you had invested Rs. 1,00,000 5 years ago, it would have grown to Rs. 2,31,310.00 (a gain of 131.31%).

Recently, Tata Steel Limited completed the acquisition of Neelachal Ispat Nigam Limited through its step-Down Subsidiary, Tata Steel Long Products Ltd.

Click here to buy Tata Steel through Groww – the smart app for buying stocks

Informative